Beware of Holiday Scams!

Scammers take advantage of the holiday season, using people’s generosity against them. According to the FBI, the two most prevalent holidays scams are “non-delivery” and “non-payment” crimes. In a non-delivery scam, a buyer pays for goods or services online but never receives them. In a non-payment scam, the seller is the victim, as goods are shipped but payment is never received. For non-payment and non-delivery scams combined, more than 44,220 complaints with losses over $276 million were already reported nationally this year.

Here’s a list of common scams with tips for how to avoid them:

- Scammers often offer too-good-to-be-true deals via phishing emails or advertisements. Such schemes may offer brand-name merchandise at extremely low prices or offer gift cards as an incentive. Other sites may offer products at a great price, but the products being sold are not the same as the products advertised.

- Consumers should steer clear of untrustworthy sites or ads offering items at unrealistic discounts or with special coupons. The victims end up paying for an item, give away personal information and credit card details, then receive nothing in return except a compromised or stolen identity.

- Consumers should beware of posts on social media sites that appear to offer vouchers or gift cards. Some may appear as holiday promotions or contests. Others may appear to be from known friends who have shared the link. Often, these scams lead consumers to participate in an online survey that is designed to steal personal information.

- If you click an ad through a social media platform, do your due diligence to check the legitimacy of the website before providing credit card or personal information.

- During the holiday season, consumers should be careful if someone asks them to purchase gift cards for them. In these scams, the victims received either a spoofed email, a spoofed phone call, or a spoofed text from a person in authority requesting the victim purchase multiple gift cards for either personal or business reasons.

- Beware of fraudulent charity scams, in which perpetrators set up false charities and profit from individuals who believe they are making donations to legitimate charitable organizations. Charity fraud rises during the holiday season, when individuals seek to make end-of-year tax deductible gifts or are reminded of those less fortunate and wish to contribute to a good cause. Seasonal charity scams can pose greater difficulties in monitoring because of their widespread reach, limited duration, and, when done over the Internet, minimal oversight. Charity scam solicitations may come through cold calls, email campaigns, crowdfunding platforms, or fake social media accounts and websites. They are designed to make it easy for victims to give money and feel like they’re making a difference. Perpetrators may divert some or all the funds for their personal use, and those most in need will never see the donations.

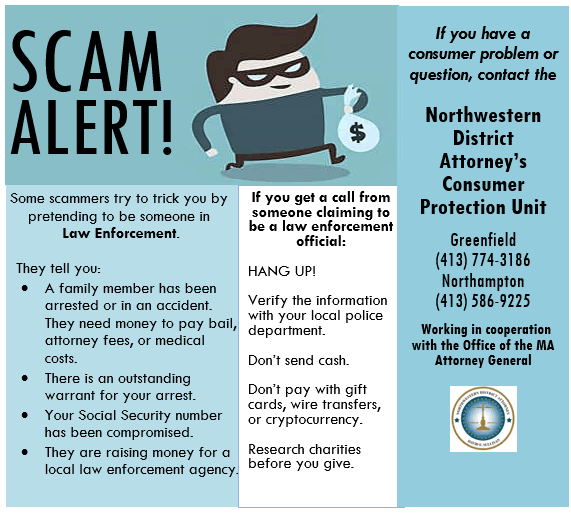

- IMPOSTER SCAMMERS pretend to be from your bank. They may use your email, cell phone number, or information they find on social media to convince you that they are from the bank in an attempt to get you to provide your bank account and debit card numbers, so they can take your money through online purchase and other means. They may call or text you. Local banks have reported this occurring in our area. Always hang up, never call back if they text or leave a message, and instead call the bank at their published number.

Tips to avoid being scammed include:

- Do your homework on the retailer/website/person to ensure legitimacy.

- Call the Better Business Bureau at 508-755-3340 or conduct a business inquiry of the online retailer on the Better Business Bureau’s website (www.bbb.org).

- Check other websites regarding the company for reviews and complaints.

- Check the contact details of the website on the “Contact Us” page, specifically the address, e-mail, and phone number, to confirm whether the retailer is legitimate.

- Be wary of online retailers offering goods at significantly discounted prices.,

- Be wary of online retailers who use a free email service instead of a company email address.

- Don’t judge a company by their website; flashy websites can be set up and taken down quickly.

- Beware of purchases or services that require payment with a gift card.

- Beware of providing credit card information when requested through unsolicited emails.

- Do not click on links contained within an unsolicited email or respond to them.

- Check credit card statements routinely. It is important to check statements after the holiday season, as many fraudulent charges can show up even several weeks later.

- Avoid filling out forms contained in email messages that ask for personal information.

- Be cautious of emails claiming to contain pictures in attached files, as the files may contain viruses. Only open attachments from known senders.

- Verify requests for personal information from any business or financial institution by contacting them using the main contact information on their official website.

- Secure credit card accounts, even rewards accounts, with strong passphrases (strings of words put together rather than a single word). Change passwords and check accounts routinely.

- Make charitable contributions directly, rather than through an intermediary, and pay via credit card or check; avoid cash donations, if possible.

- Beware of organizations with copycat names similar to reputable charities; most legitimate charity websites use “.org” (NOT .com).

If you are a victim of a scam, contact your financial institution immediately upon discovering any fraudulent or suspicious activity and direct them to stop or reverse the transactions. In addition, contact your local police department to file a report.