Understanding Medicare Enrollment Periods and Options

Are you turning 65? Have you been disabled for 24 months? If so, you may be eligible for Medicare. Medicare is the federal health insurance program that helps with the cost of health care, but it is not comprehensive; it does not cover all medical expenses or the cost of long-term care.

Different parts of Medicare help cover specific services:

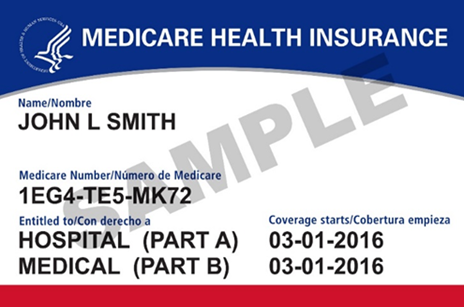

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part D: Prescription Drug Coverage

Who is eligible?

Individuals who are 65 years or older and U.S. citizens or lawfully permitted residents for 5 years are eligible. Medicare is also available to certain people who are under 65 who receive Social Security Disability benefits for 24 months and to people who have Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s Disease, or End Stage Renal Disease (ESRD).

Most people are eligible for Part A, if they have paid into Medicare taxes long enough through their own or a spouse’s or ex-spouse’s work record.

How do you enroll? Social Security handles enrollment into Medicare Parts A and B. If you are not receiving Social Security benefits, you will need to enroll by physically going to a local Social Security office, by making an appointment to enroll over the phone, or online at www.ssa.gov. Make sure you do this early, as our local Social Security office is very busy!

If you already receive benefits from Social Security, you will automatically receive Medicare A and B a few months before you turn 65. If you are under 65 and receiving Social Security Disability benefits, you will receive it before your 25th month of disability.

There are several enrollment periods to be aware of if you do not have Medicare. First, the Initial Enrollment Period (IEP), is the period of time that surrounds your 65th birthday, including the three months before your birthday, the month of your birthday, and the three months following your birthday. Most people sign up for Medicare at this time, unless they are continuing to work and/or are covered under a spouse’s work through an Employer Group Health Plan. The Initial Enrollment Period for a person who is receiving benefits through Social Security Disability begins three months before their 25th month of disability payments, includes the 25th month, and ends 3 months after.

Next is the Special Enrollment Period (SEP). It is the opportunity to enroll in Medicare outside the Initial Enrollment Period or General Enrollment Period for people who didn’t enroll in Medicare when first eligible, because they or their spouse are still working and have employer-sponsored Group Health Plan coverage based on their employment. This Employer Coverage allows them to defer Medicare Part B until they retire. So, if you are over 65 and you have health insurance through a job and are still working, you can sign up for Part A and Part B any time as long as you have Group Health Plan coverage through your or your spouse’s employment.

One important note regarding the SEP is that employer coverage for retirees, or through COBRA, doesn’t count as current employment, so individuals with these types of coverage don’t qualify for a SEP to enroll in Medicare.

The last period is the General Enrollment Period (GEP). This period is for individuals who miss their IEP, and allows you to sign up. Medicare’s GEP lasts January 1–March 31, with coverage starting July 1.

There are a few things to understand about penalties. If you enroll late, the Part B penalty is a surcharge added to your monthly Part B premium for life. The Part B late enrollment penalty is calculated as 10% of the current Part B premium for every 12 month period you were not enrolled and did not have employer coverage through current employment.

If you do not have Part D coverage, even if you take no prescription drugs, you can incur a lifetime penalty. If you enroll late, the Part D penalty is calculated as 1% of the national base beneficiary premium for each month you were not enrolled in a Part D plan and did not have creditable coverage. That is 33 cents a month in 2022.

It makes your head spin, right? So many rules to know and we have not even discussed additional coverage!

Because Medicare is not all-inclusive, most people purchase additional coverage, including Medigap Supplemental Plans (aka Medicare Supplemental Plans), Medicare Advantage Plans (Part C), Prescription Drug Coverage (Part D), Retiree Plans, and Veterans’ Benefits.

This is where SHINE Counselors come in handy. We have free, detailed information and knowledge to assist you in making the best decision, based on your financial situation, your medical insurance needs (based on your health conditions), and your comfort with the coverage you choose.

Additionally there are a few very helpful handouts I recommend for someone turning 65 or becoming eligible for Medicare:

These publications are available through the SHINE webpage, or you can simply call the SHINE Program directly and request we mail or email them to you.

The SHINE program, Serving the Health Insurance Needs of Everyone, provides confidential and unbiased health insurance counseling for Medicare beneficiaries. This is a free service, though contributions are welcome and will go a long way to help support this vital program. For further assistance with any Medicare issue, you can make a SHINE appointment. To reach a trained and certified counselor in your area, contact the regional office at 1-800-498-4232 or 413-773-5555, or contact your local council on aging.