Get $25 Worth of Farmer’s Market Coupons for Free!

Craving some fresh squash or ripe strawberries? LifePath will be distributing free farmer’s market coupon booklets, worth $25 per person. One of these coupon booklets could be yours! The coupons are part of a program from the Massachusetts Department of Agricultural Resources, designed to help older adults get fresh fruits and vegetables and to help

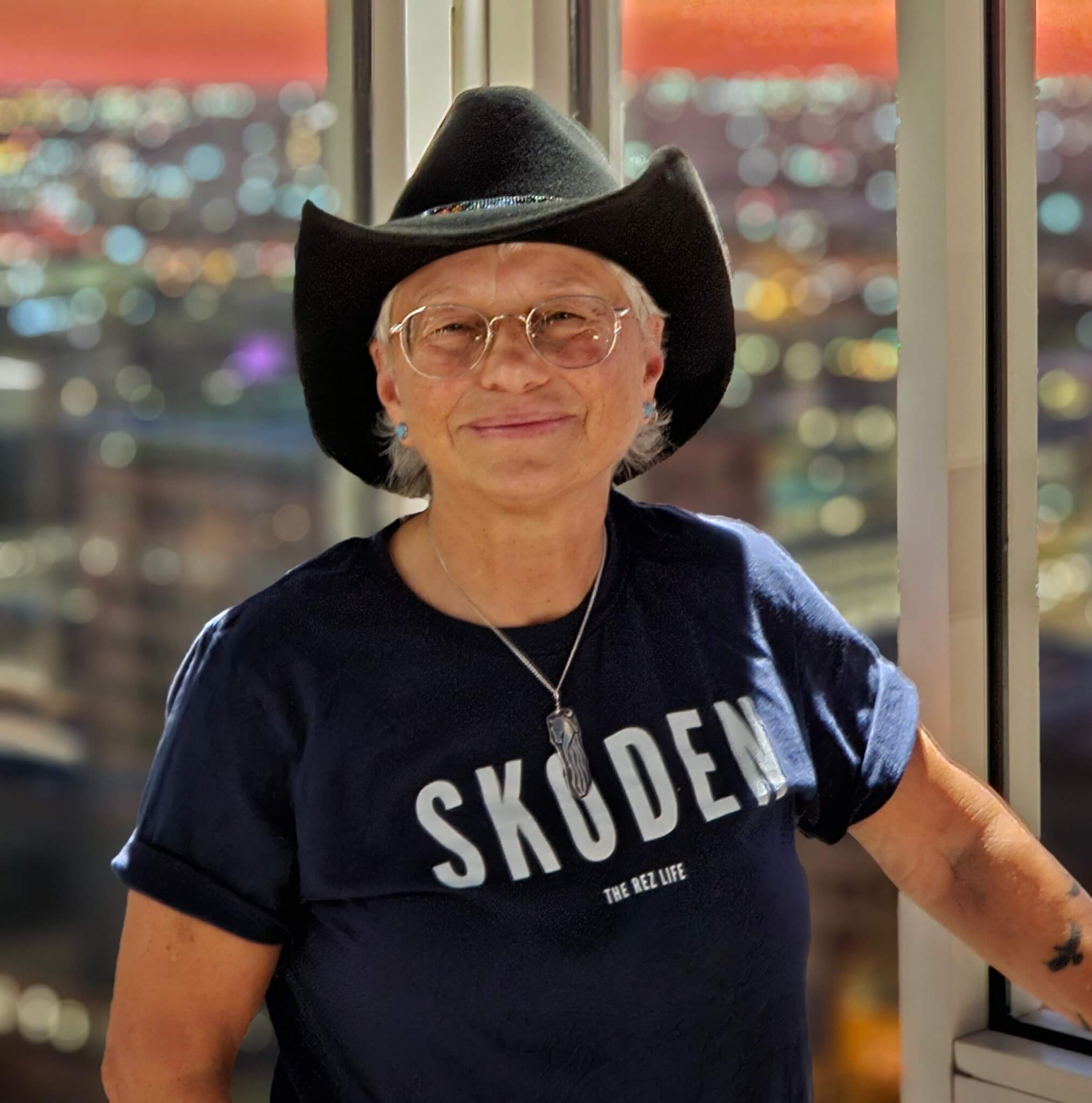

Rethinking the Senior Center: Age & Dementia Friendly South County

When people hear “senior center,” they usually picture a place older adults gather for programs and activities. But what if a senior center became something more—a place that leads its community in asking bigger questions, such as: What kind of community are we for older adults and people living with dementia? What kind of community

Beacons of Hope Around Us Help to Light Our Way

The other night I came across one of the great wonders of the summertime season. The flight of a firefly! I haven’t seen fireflies in my backyard in quite some time, so you can imagine my surprise when I spotted one last week. I am amazed at the simple beauty of a firefly as it

Nutrition Notes: Fortify Your Diet with Seeds

Seeds can be an important part of a healthy diet, providing essential nutrients that may be otherwise hard to get. Pumpkin, sesame, sunflower, flax, and chia seeds are a few of my favorites that I use all the time. I always top off a spring salad with a sprinkle of seeds like sunflower, pumpkin, and

Self-Neglect: Recognizing and Reducing the Effect on Older Adults

Recently, I was assigned to a case in Adult Protective Services for a woman named Brooke*. Brooke had always been independent throughout the years. After her husband passed away unexpectedly, Brooke single-handedly raised her three children while working full-time and managing her home. After her children moved away and began their own lives, Brooke maintained